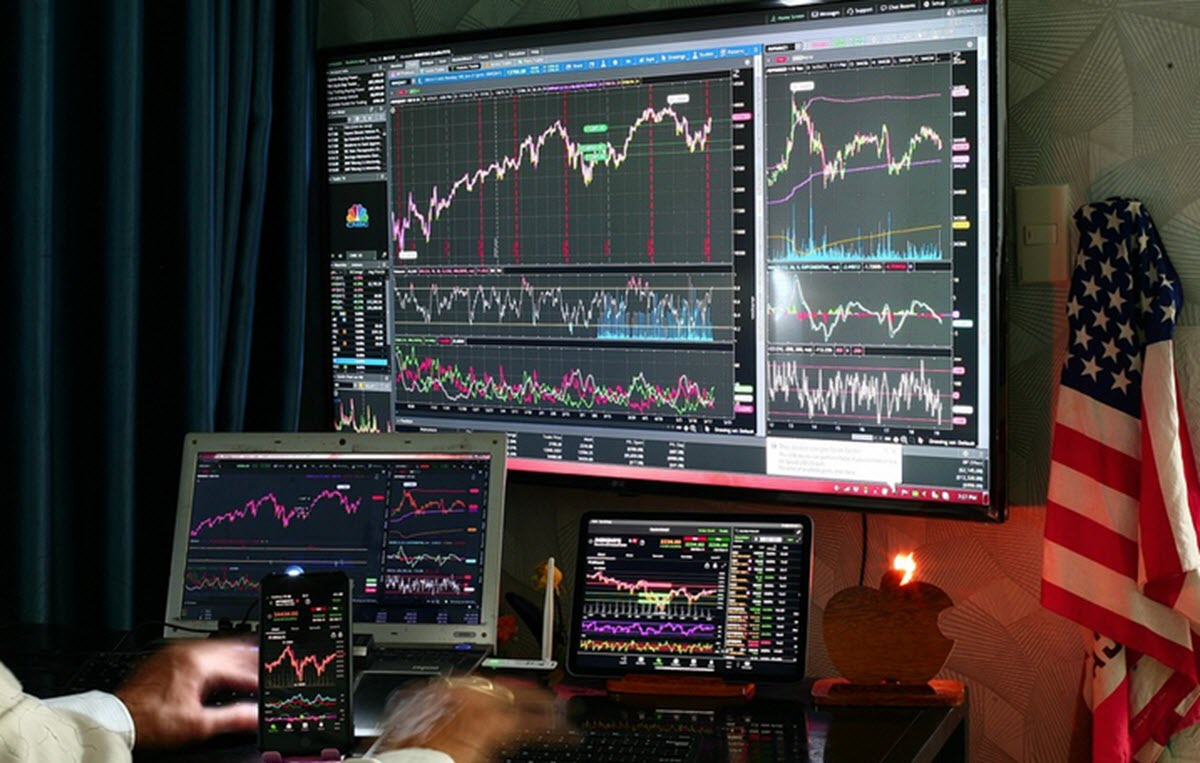

Forex trading, short for “foreign exchange trading,” is the act of buying and selling currencies on the global foreign exchange market. The forex market is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion. It operates 24 hours a day, five days a week, as trading occurs across various time zones from major financial centres such as London, New York, Tokyo, and Sydney.

The Goal of forex trading

The primary goal of forex trading is to profit from the fluctuations in currency exchange rates. Traders speculate on the future direction of a currency pair (e.g., EUR/USD, USD/JPY) and execute trades accordingly. If a trader believes that the value of one currency will appreciate against another, they will buy the currency pair (go long). Conversely, if they believe the value will depreciate, they will sell the currency pair (go short).

Who trades on the Forex market

Forex trading appeals to various market participants, including individual retail traders, institutional investors, banks, and corporations. Some participants use forex trading as a means of hedging currency risk, while others use it for speculative purposes, aiming to generate profits from market movements.

Various trading strategies and styles within the forex market include day trading, swing trading, scalping, and position trading. These strategies cater to different trader preferences, risk tolerances, and time horizons.

High risk

Forex trading typically involves leveraging, which means using borrowed funds to increase potential returns on investment. While leveraging can amplify gains, it can also magnify losses, making forex trading a high-risk endeavour for inexperienced or under-capitalized traders. As such, it is essential to understand the risks involved and employ prudent risk management strategies when engaging in forex trading.

This article was last updated on: April 4, 2023